Properties of Money

Money is never at rest. What? We can hold money and feel it in our hands. Its counter intuitive to think of it being in a state of motion.

Actually, the curve defining the motion of money is expressed as.

y = (1+r) ** x

Lets unpack what this means..

The two stars in the curve represents the exponent operator. This is basically saying that money behaves somewhat like a physical body in acceleration. Money is not just in perpetual motion. Its in perpetual acceleration.

Actually even the above is an approximation. The acceleration of money dont obey the laws that govern physical motion. Because x is in the right side of the exponent operator, even higher order derivatives of the above function maintain its shape. The curve is a concise way of saying "Your money is not only static, but moving. It not only moving but accelerating. Its not only accelerating but acc:accelerating. Its not only acc:accelerating but acc:acc:accelerating ... ad infinitum"

Because money is not only moving, but also acc:acc:acc..accelerating its difficult to estimate where it would be at a point far right on the x axis. Unless you can do differential equations in your head, your estimates will probably be gross underestimates.

The following may be deduced from the relation between Money and time

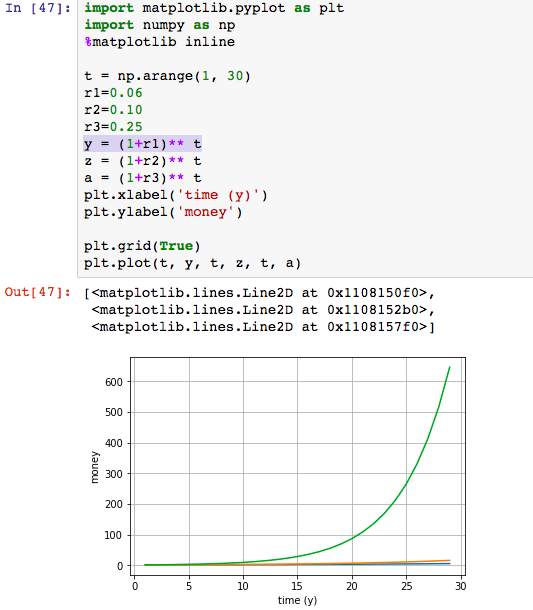

- Dont be fooled by differences in initial outcomes. There is very little difference between the y positions between the curves for the same initial few x positions. But you sure "pull away" at higher 'r's.

- r is everything. This is the annual rate at which your money moves. This is what your Bank gives you. This is the return Mutual Funds promise you. This is the return you hope when you invest in real estate. Its the return you might make in your equity portfolio. In short r represents the current state of your deployed monies.

- The coefficient r also represents the quality of your decisions you make around money. r represents the discipline and patience you have carefully engineered for yourself. r represents every micro improvements you have made at various stages in life. Earlier improvements being vastly more effective to outcomes than improvements made later. Hence it pays to start working on r today. This is akin to choosing which of the 3 curves you want to onboard today.

- Dont get too busy with your lives before you have optimised your coefficients. One way to think of this is, - by developing useful habits and abstractions around money you can avoid huge regrets 30 years down the line. The difference between 2 points in 2 curves in the y axis represents the quantum of regret. Example regret @15X (or super over joy @650X) is what you will experience in 2050. Thats a certainty. So it pays to plan backwards from that point.

- Dont be risk-averse too early in life. One way to think about this is, - just be conservative for the money you absolutely need. For the remaining surplus, be calculative, creative and daring. It hurts being unnecessarily conservative.

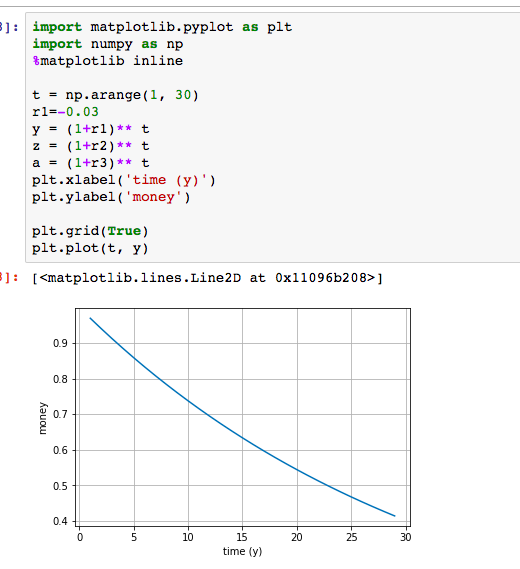

- And finally never never let money remain idle or making you sub par 'r's. E.g letting money remain in your salary account, or stacked up in your cupboard, earns you negative r in real terms because of inflation. This has the effect of your money evaporating into thin air. Like a radioactive element with a half life. This is the worst curve to be riding on.

What curve are your monies riding on today? Thinking of money as being in perpetual acceleration is critical if you want to engineer a joyful outcome in the long term.